Finioma Data Processing and Reconciliation (FDPR) is a modern SaaS platform designed to eliminate the pain of manual data handling.

Traditional reconciliation and processing often depend on Excel spreadsheets, macros, or partial VBA automation—methods that are slow, error-prone, and difficult to maintain.

With FDPR, these tasks become structured, fully automated, and cloud-based. The result: faster processing, higher accuracy, and consistent outcomes—all while freeing your team from repetitive manual work.

And importantly, FDPR does not store your data files, ensuring security and compliance remain uncompromised.

By moving beyond outdated manual workflows, FDPR allows you to focus on analysis, insights, and business value—instead of spreadsheet troubleshooting.

What This Series Covers

- FDPR at a glance

- Reconcile Bank statement with accounting (video)

- Generate PDF invoices (this post)

- Compare data from different systems

- FDPR deep dive

The Challenge

Many organizations either don’t have accounting software that can generate automated invoices or are still tracking sales manually in Excel.

Manually creating PDF invoices is time-consuming and prone to errors. FDPR automates this process by generating professional PDF invoices directly from your Excel source data.

The Process

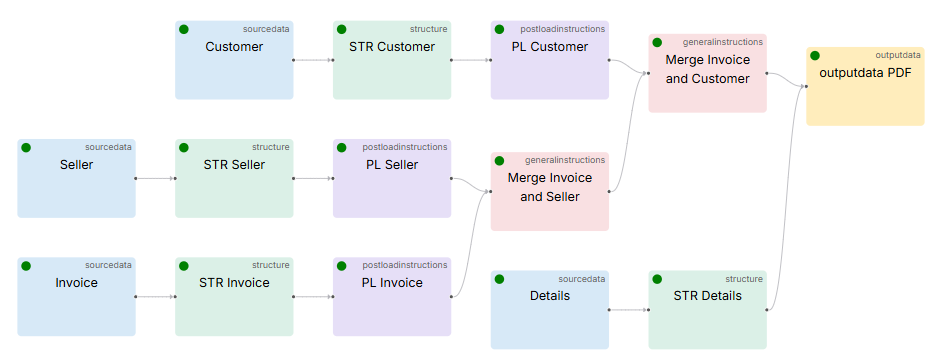

Step 1 – Standardize and Merge Source Data

- Import source data:

- Customer list with addresses

- Invoice header and details

- Seller details

- Prefix header columns to prevent duplicate field names (e.g., both “Customer” and “Seller” tables may have “Name” and “Address” fields).

- Merge header and detail data using the key column (e.g., “Invoice Customer ID” with “Customer ID”).

Step 2 – Build the PDF Template

- Create or adapt an HTML template (no restrictions beyond standard HTML/CSS).

- Include all referenced assets (images, CSS, fonts) or ensure paths are accessible.

- Add PDF-specific features such as headers, footers, and page numbers using CSS.

- Insert dynamic placeholders (e.g., {{ customer_name }}, {{ invoice_total }}) for automatic population.

Step 3 – Render the Invoice

- Generate one polished PDF per unique key column value, ready for distribution or archiving.

Specific Setup Tips

- Prefixing Header Columns

- FDPR can automatically prefix column names to avoid duplicates, ensuring clean merges between datasets.

- Merging Data

- Combine invoice, customer and seller data by matching fields such as “Invoice Customer ID” and “Customer ID.”

- Creating the Template

- Use HTML/CSS for flexibility. Include local assets (images) or embed critical elements for portability. Provide fallback fonts to guarantee consistent rendering.

- PDF-Specific Functionalities

- Use CSS for headers, footers, and page numbers

- Dynamic Fields

- Insert variables directly into the template.

Output

With FDPR, your finance team can move from raw data to professional invoices in just a few clicks. The system automatically fills in customer and invoice details, generating one PDF per record—fast, accurate, and ready for distribution or archiving.

Why Use FDPR?

✅ Fewer errors compared to manual, spreadsheet-based workflows

✅ No-code setup through an extensive library of instructions

✅ No new system interfaces—work directly from existing files and listings

✅ Fully automatable via API for hands-free runs

About the author

Marcel Frey

Marcel Frey has been working in IT and Business consulting for more than 25 years. He holds a Master in Business Economics from the University of Lausanne. Mr. Frey has been working with planning and consolidation systems since it’s early days, his current focus is on the latest generation of legal consolidation tools and data reconciliation topics.